Services

Accounting Software

Accounting Software Services

The benefits of choosing the right accounting software makes life simpler by easing the administrative burden and providing valuable , timely and accurate information on which to make decision

Our qualified team of chartered accountants is here to assist you. We can assess what information your company needs to give HMRC and Companies House with just one phone call. We can assist with collating all the relevant information required and guide you through the filing process and help you rectify any errors.

Working with us also gives you access to a wealth of expert advice that can help you improve your financial reporting.

At FAZ Accountancy Services, we are very proud of our prompt delivery service with minimal fuss. Our job is to gather all the essential paperwork, go away and do the necessary number crunching, and prepare full accounts very quickly.

We proactively try to complete your company annual accounts (or your tax returns if self-employed) within 1 to 2 weeks from receiving the relevant information you send us. We always file your set of accounts with HMRC before your deadline date (9 months after the year-end).

Knowing what information is required means you will never have to worry about running around last minute to get things ready for HMRC and risk forgetting vital paperwork and possibly incurring a fine.

We will take care of this process for you as we will get in touch well in advance to remind you of any information we need or any payments required.

What’s Accounting Software Services?

- Digital tools for financial management.

- Automates bookkeeping, invoicing, payroll, and taxes.

- Provides real-time financial data.

- Cloud-based for accessibility and collaboration.

- Integrates with other business systems.

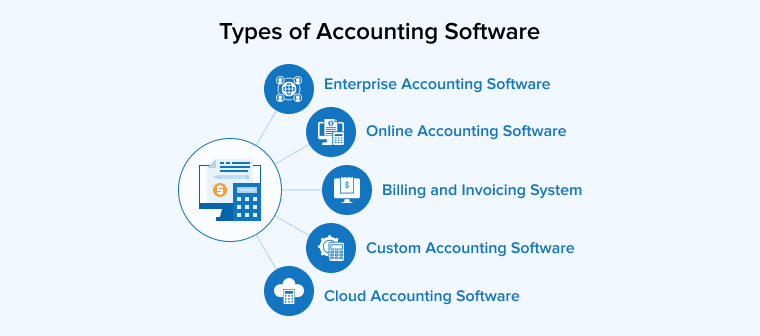

Different types of Accountancy

Enterprise accounting software that is purely designed for Enterprise needs and majorly customized according to their needs. Such software helps manage the operational complexity that larger businesses may have. Accounting software for larger businesses might also incorporate accounting systems with additional software services including project planning, business analytics, enterprise resource planning, and workflow management

Online accounting software is a cloud-based solution that allows users to manage financial transactions, bookkeeping, and reporting over the internet. It provides real-time access to financial data from any device with an internet connection, enhancing accessibility and collaboration.

One of the widely used types of accounting software is a billing and invoicing system. It is a software type that can be used by companies to record the transactions carried out by the firm. The process in this system is often carried out via ATDs (automated telephone devices), online payments, and credit card processing. Basically, this type of software helps automatically create and send invoices without any scope for human error.

As it goes by the name, you can create custom accounting software as per the enterprise’s needs. A company develops its own accounting application. This accounting solution frequently works well when a company wants to expand, using the skills of talented employees to design software and handle various accounting circumstances.

Cloud-based accounting software has a lot of benefits, including that it acts like invoicing software, business intelligence, customer relationship management, data backup, and disaster recovery are typically included in your account.

FAQ

Accountancy services are essential for maintaining accurate financial records, ensuring regulatory compliance, and providing insights for strategic decision-making. They help businesses manage cash flow, prepare for tax season, and identify opportunities for cost savings and growth.

To choose the right accounting service, consider your business size, industry, specific financial needs, and budget. Look for a provider with relevant expertise, good reputation, and reliable customer support. It’s also important to ensure that the accounting service can scale with your business growth.

Yes, accounting services can help with financial planning by providing budgeting, forecasting, and strategic planning support. They offer insights into financial performance, help set financial goals, and create plans to achieve those goals.

Accounting services support business growth by providing accurate financial information, identifying cost-saving opportunities, ensuring tax compliance, and offering strategic advice. They help businesses manage resources effectively and plan for sustainable growth.

It is recommended to review financial statements monthly to ensure accuracy and make timely decisions. Regular reviews help identify trends, monitor financial performance, and address any issues promptly.